The trendline is formed by connecting the highs on the chart, while the support line is formed by connecting the lows. To identify a descending wedge pattern, you need to look for two critical elements on the stock chart-first, a downward-sloping trendline and then a similar support line. It doesn’t matter if you’re trading penny stocks or Apple ( NASDAQ: AAPL) the descending wedge pattern is the same. It is typically seen during a bearish trend, but it can signal that a stock is about to reverse course. The descending wedge or “falling wedge” stock chart pattern is a technical analysis tool that can be used to identify potential trading opportunities. Today we answer the question: What is an ascending triangle chart pattern? Descending Wedge Definition & Example But once that gets priced in, a lot of the short-term action can be translated by reading chart patterns. Therefore, technical analysis is important if you’re not looking to invest in penny stocks and trade them instead.įinding catalysts like news or corporate filings is an excellent first step in identifying momentum. Unique economic conditions, high inflation, and headline risk bring plenty of fluctuation to the stock market today. If you’re putting money into the stock market today, it is in one of the most volatile environments in recent history. In a bullish trend what seems to be a Rising Wedge may actually be a Flag or a Pennant (stepbrother of a wedge) requiring about 4 weeks to complete.In this Penny Stocks Chart School series, we’ll discuss some of the most popular trading patterns active traders use. A rising wedge is more reliable when found in a bearish market. As far as volumes are concerned, they keep on declining with each new price advance or wave up, indicating that the demand is weakening at the higher price level. Prices usually decline after breaking through the lower boundary line. Although both lines point in the same direction, the lower line rises at a steeper angle than the upper one.

In a rising wedge, both boundary lines slant up from left to right. When this pattern is found in a downtrend, it is considered a bearish pattern, as the market range becomes narrower into the correction, indicating that the correction is losing strength, and that the resumption of the downtrend is in the making.

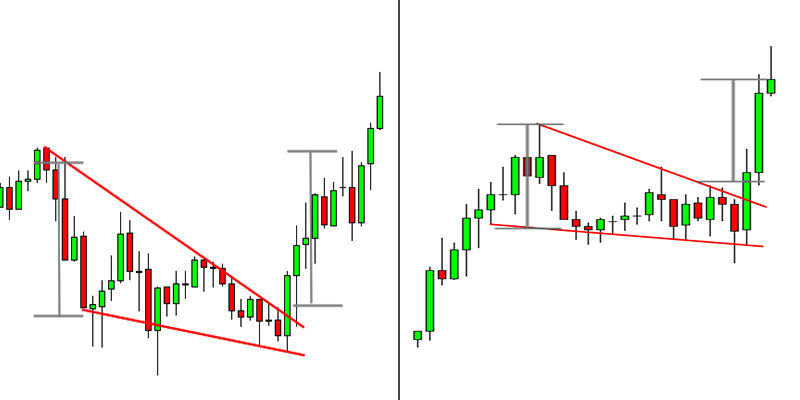

When this pattern is found in an uptrend, it is considered a reversal pattern, as the contraction of the range indicates that the uptrend is losing strength. The rising wedge pattern is characterized by a chart pattern which forms when the market makes higher highs and higher lows with a contracting range. Once prices move out of the specific boundary lines of a falling wedge, they are more likely to move sideways and saucer-out before they resume the basic trend. There comes the breaking point, and trading activity after the breakout differs. Volume keeps on diminishing and trading activity slows down due to narrowing prices. The upper descends at a steeper angle than the lower line. In a falling wedge, both boundary lines slant down from left to right. When this pattern is found in an uptrend, it is considered a bullish pattern, as the market range becomes narrower into the correction, indicating that the downward trend is losing strength and the resumption of the uptrend is in the making. When this pattern is found in a downward trend, it is considered a reversal pattern, as the contraction of the range indicates the downtrend is losing steam. The falling wedge pattern is characterized by a chart pattern which forms when the market makes lower lows and lower highs with a contracting range. Once that basic or primary trend resumes itself, the wedge pattern loses its effectiveness as a technical indicator. As they are reserved for minor trends, they are not considered to be major patterns. Falling and rising wedges are a small part of intermediate or major trend.

Price breaking out point creates another difference from the triangle. It differs from the triangle in the sense that both boundary lines either slope up or down. This pattern has a rising or falling slant pointing in the same direction. It should take about 3 to 4 weeks to complete the wedge. It is a type of formation in which trading activities are confined within converging straight lines which form a pattern. The pattern is characterized by a contracting range in prices coupled with an upward trend in prices (known as a rising wedge) or a downward trend in prices (known as a falling wedge).Ī wedge pattern is considered to be a pattern which is forming at the top or bottom of the trend. On the technical analysis chart, a wedge pattern is a market trend commonly found in traded assets ( stocks, bonds, futures, etc.).

0 kommentar(er)

0 kommentar(er)